The sticker price of an e-bike is a misleading indicator of its true cost; the smarter investment is determined by its Total Cost of Ownership and depreciation risk.

- Direct-to-consumer (DTC) bikes often carry hidden costs in assembly, warranty claims, and rapid depreciation that erode initial savings.

- Local bike shops provide a service and support infrastructure that preserves the bike’s value and minimizes long-term expenses.

Recommendation: Evaluate any e-bike purchase not by its initial price, but by projecting its three-year cost, including service, potential repairs, and resale value.

The digital marketplace dangles a tempting proposition: a feature-packed e-bike, delivered to your door for hundreds, sometimes thousands, less than a comparable model at your local bike shop. For the aspiring e-bike owner, the choice seems obvious. Yet, as a consultant in the cycling industry, I advise clients to treat this decision not as a simple purchase, but as a financial analysis. The most critical question isn’t “What is the price?” but “What is the Total Cost of Ownership (TCO)?”

Common wisdom pits the convenience and low prices of online brands against the service and expertise of local shops. This is a superficial view. The real calculation involves factoring in non-obvious financial liabilities: assembly fees, the cost of labor for warranty work, shipping expenses for repairs, and the significant impact of brand reputation on resale value. An attractive online price can quickly become a high-cost headache, a phenomenon I call the “serviceability liability.”

This guide moves beyond the simple price tag. We will dissect the financial implications of each purchasing channel. We will quantify the value of a local warranty, assess the risk of non-certified components, and analyze the depreciation curves of different types of e-bikes. By the end, you will have a clear framework to determine which path—direct-to-consumer or local shop—truly protects your investment and delivers the best long-term value.

This article provides a complete financial framework for making an informed e-bike purchasing decision. Explore the sections below to understand the specific variables that impact your investment.

Summary: Direct-to-Consumer vs Local Shop: A Financial Breakdown for E-Bike Buyers

- Why a 2-Year Local Warranty Is Worth $500 More

- How to Conduct a Proper Test Ride in 20 Minutes

- UL Certification: Why Insurance Companies Are Demanding It

- The Risk of “White Label” Drop-Shipped E-Bikes

- End of Season Sales: When to Buy for Maximum Discounts

- How Resale Value Varies Between Name Brand and Generic Bikes

- Reporting Issues Immediately: The Statute of Limitations on Defects

- Step-Through or High-Step: Which Frame Geometry Fits Your Life?

Why a 2-Year Local Warranty Is Worth $500 More

In financial analysis, a warranty is not a feature; it’s a pre-paid service and insurance contract. Direct-to-consumer (DTC) brands often advertise generous “parts-only” warranties, but this conceals significant out-of-pocket expenses that are covered by a local shop’s comprehensive warranty. The initial savings on a DTC bike are quickly eroded when you factor in these mandatory, unbudgeted costs.

The true value of a local warranty becomes clear when you quantify the hidden liabilities of a DTC purchase. A professional assembly, which is crucial for safety and performance, can cost between $100 and $250. If a warranty issue arises, the owner is responsible for shipping the bike back to the manufacturer, a cost often exceeding $150 each way. Most critically, DTC warranties rarely cover labor, which shops charge at $75 to $150 per hour. When you consider the bike’s downtime—weeks for shipping versus days for local service—the financial and practical benefits of a local purchase become undeniable. In fact, industry experts confirm that labor coverage alone can add $500 to $800 in real value over a parts-only warranty.

This disparity is best understood through a direct cost comparison. A local shop’s price includes the assembly, service, and labor that you must purchase separately with a DTC bike.

| Warranty Aspect | Direct-to-Consumer | Local Shop |

|---|---|---|

| Initial Assembly | $100-$250 professional assembly | Included in purchase |

| Shipping for Warranty | $150+ each way | Drop off & pick up locally |

| Labor Coverage | Parts only – labor $75-$150/hr | Parts & labor included |

| Downtime | 2-4 weeks shipping + repair | 1-3 days typical |

| Parts Availability | Proprietary parts may take weeks | Standard components in stock |

This analysis reveals that a significant portion of a local shop’s higher sticker price is simply pre-paying for essential services that are unavoidable expenses with a DTC model. It’s a classic case of paying less now to pay much more later.

How to Conduct a Proper Test Ride in 20 Minutes

A test ride is not an audition for fun; it is a critical step in your financial due diligence. For an asset of this value, skipping the test ride is equivalent to buying a car without driving it. This is a primary advantage of a local shop that is nearly impossible to replicate in a DTC model. An effective test ride isn’t a casual spin around the block but a structured, 20-minute inspection designed to identify potential issues and assess the bike’s suitability for your specific needs, thereby mitigating the risk of a poor investment.

This process allows you to evaluate the core components under realistic stress. You can feel for frame flex in turns, listen for motor strain on hills, and test the nuances of brake modulation. It’s an opportunity to uncover issues that wouldn’t be apparent from an online spec sheet. This hands-on inspection is your best defense against buyer’s remorse and ensures the bike’s performance aligns with its price tag.

As the image illustrates, a key part of the local shop experience is access to expertise. A good mechanic can point out nuances in fit and function that an untrained eye would miss, providing an invaluable layer of quality control before you commit your capital. Use the following checklist to structure your test ride like a professional inspector.

Your 20-Minute E-Bike Due Diligence Checklist

- Motor Response & Noise: Test the motor’s reaction from a dead stop on flat ground and listen for excessive noise while climbing a steep hill under heavy load.

- Frame Integrity: Perform sharp turns at a moderate speed to feel for any disconcerting frame flex, a sign of lower-quality construction.

- Brake Performance: Evaluate brake modulation and power at various speeds, not just by performing an emergency stop. Check for smooth, predictable stopping power.

- Ergonomics & Controls: Ride for at least five minutes in your typical posture. Ensure you can operate controls and read the display easily without looking down.

- Practicality Audit: Test the walk-assist mode on a ramp. Attempt to lift the bike as if you were loading it onto a car rack to gauge its real-world weight and handling.

A bike that fails any of these practical tests may be a poor long-term investment, regardless of its online reviews or initial price.

UL Certification: Why Insurance Companies Are Demanding It

From a purely financial perspective, the small UL (Underwriters Laboratories) logo on an e-bike’s battery and electrical system is one of the most important features to look for. It is not a gimmick; it is a critical risk-management tool. The lack of a UL 2849 or UL 2271 certification on an e-bike represents a significant and uninsurable financial liability. Insurance companies are increasingly aware of the fire risks posed by cheap, uncertified lithium-ion batteries, and are beginning to use non-certification as grounds to deny claims.

If an uncertified e-bike battery causes a fire, homeowner’s or renter’s insurance may deny the entire claim, citing the use of a non-certified device.

– Insurance industry experts, BikeInsure Guide 2024

The danger is not theoretical. According to New York City fire department data, lithium-ion batteries from micromobility devices were responsible for 318 fires, 226 injuries, and 10 deaths between 2021 and 2022 alone. Faced with this data, purchasing a non-certified e-bike to save a few hundred dollars is an act of extreme financial imprudence. The potential loss of your home and all possessions far outweighs any initial savings.

Governments and regulatory bodies are now codifying this risk. A prime example is California’s recent legislation, which moves UL certification from a ‘nice-to-have’ feature to a legal requirement.

Case Study: California’s Mandatory E-Bike Certification Law

As a clear indicator of market direction, a law passed in California effectively makes UL certification mandatory. Starting January 1, 2026, all e-bike batteries sold in the state must meet UL 2849 or the European EN 15194 standards. Retailers are prohibited from selling uncertified units, with violations subject to penalties. The law, detailed by legal experts, requires clear labeling showing the testing lab’s name and the specific certification standard met. This legislation transforms a safety recommendation into a legal and financial baseline for the entire industry.

When evaluating an e-bike, the absence of a UL certification should be a non-negotiable deal-breaker. It signals that the manufacturer has cut corners on the single most volatile component of the bike, exposing you to catastrophic risk.

The Risk of “White Label” Drop-Shipped E-Bikes

The internet is flooded with “white label” e-bikes: generic models produced in mass by a handful of overseas factories and sold under dozens of different, often fleeting, brand names. While the specifications may look impressive on paper, these products represent a high-risk asset class for consumers. Their primary selling point is a low price, achieved by compromising on component quality, engineering, and, most importantly, long-term parts availability. This creates a significant depreciation risk.

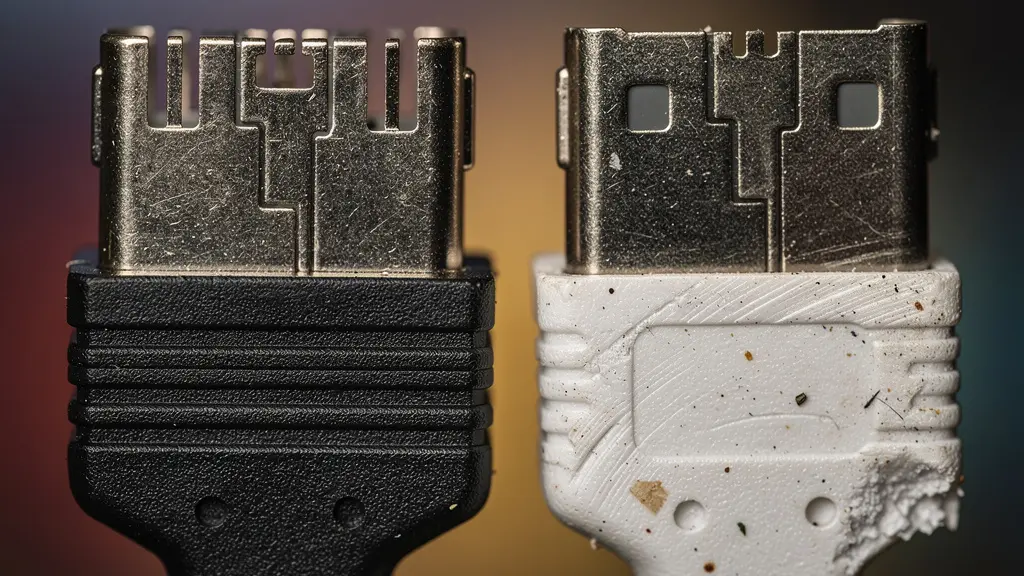

The core issue is the use of proprietary, low-quality components. While a name-brand bike from a local shop uses standardized parts (from Shimano, Bosch, SRAM), a white-label bike often uses bespoke connectors, controllers, and motor parts that are incompatible with anything else on the market. When a part fails—and with lower quality control, it’s a matter of when, not if—the owner is entirely dependent on the fleeting online “brand” for a replacement. If that brand has vanished, the entire e-bike can become a multi-thousand-dollar piece of scrap metal.

The material difference is often visible to the naked eye. As this detailed comparison shows, the precise machining and quality materials of a standard component (left) stand in stark contrast to the rougher molding and inferior contacts of a generic white-label part (right). This difference in build quality translates directly to reliability and service life, impacting the bike’s long-term financial performance. This is why a recent depreciation analysis shows that name-brand e-bikes often retain around 50% of their value after three years, whereas generic DTC bikes can plummet to as low as 17%.

This “serviceability liability” is a major reason many bike shops refuse to work on a large number of online-only brands. They cannot guarantee repairs when they can’t source the parts, creating a frustrating and costly dead-end for the bike’s owner.

End of Season Sales: When to Buy for Maximum Discounts

Treating the e-bike market like a financial market provides strategic advantages. Just as with cars, the cycling industry operates on a model-year cycle. This creates predictable windows of opportunity for savvy buyers to acquire a high-quality asset at a discounted price. The key is to understand the inventory pressures faced by both manufacturers and local retailers.

The prime buying season typically runs from late summer through fall, specifically August to October. During this period, brands are preparing to launch the next model year’s lineup. Retailers need to clear floor space for incoming inventory, making them more willing to negotiate on current-year models. Often, the “new” models feature only minor changes—a new color, a slightly updated component—while the core frame and motor technology remain identical. Buying the outgoing model can yield discounts of 15-30% on a brand-new, fully warrantied bike from a local shop, effectively erasing the price gap with a lower-quality DTC alternative.

Another strategic time to buy is during major holiday sales events, such as Black Friday or end-of-year clearance. However, these sales often have limited stock, so it requires monitoring and decisiveness. The worst time to buy, from a purely financial standpoint, is in the spring (March-May). Demand is at its peak, new models have just arrived, and discounts are virtually non-existent.

By timing your purchase to coincide with these market cycles, you can acquire a superior, serviceable, and high-resale-value bike from a local shop for a price that is competitive with, or even better than, the perceived “bargains” online. This is the essence of smart asset acquisition: maximizing quality while minimizing capital outlay.

How Resale Value Varies Between Name Brand and Generic Bikes

An e-bike is a depreciating asset, but not all e-bikes depreciate equally. The single biggest factor influencing resale value is brand reputation. A well-known brand (like Trek, Specialized, or Giant) serves as a financial backstop, assuring a future buyer of quality, parts availability, and serviceability. In contrast, a generic or white-label DTC brand carries a high degree of uncertainty, causing its value to plummet the moment it’s unboxed. This difference in depreciation is a direct and quantifiable cost of choosing a lesser-known online brand.

The secondary market for e-bikes is sophisticated. Buyers are wary of “disposable” bikes and are willing to pay a premium for assets that can be maintained. A bike purchased from and serviced by a local shop comes with an implicit guarantee of quality and often a documented service history, which further bolsters its value.

Case Study: The Financial Impact of Service History

Analysis of the used e-bike market shows a clear trend: e-bikes with a documented service history from a reputable local shop command a 15-20% higher resale price than comparable models without one. Furthermore, bikes equipped with serviceable, mid-drive motors from established brands like Bosch, Shimano, or Yamaha typically add $300-$800 to the resale value compared to bikes with generic hub motors, primarily due to the confidence buyers have in long-term parts availability and expert service.

The following table, based on market data, illustrates the stark reality of e-bike depreciation. An initial “savings” of $500 on a DTC bike can result in a $1,500 loss in resale value over three years, making it a poor financial choice.

Data from an analysis of the used e-bike market clearly shows how different brand tiers perform over time.

| Time Period | Premium Brands (Trek, Specialized) | Mid-Range Brands | Generic/DTC Brands |

|---|---|---|---|

| Year 1 | 60-70% retained value | 50-60% retained value | 40-50% retained value |

| Year 2 | 55-65% retained value | 40-50% retained value | 25-35% retained value |

| Year 3 | 45-55% retained value | 30-40% retained value | 15-25% retained value |

This demonstrates that the purchase of a name-brand bike from a local shop is not just an expense, but an investment in an asset with a more predictable and stable residual value.

Reporting Issues Immediately: The Statute of Limitations on Defects

When you purchase a DTC e-bike, you become your own project manager, quality control inspector, and warranty administrator. Time is of the essence. Most consumer protection mechanisms, including credit card chargebacks, have strict time limits. Delaying the inspection and reporting of any defects can leave you with no financial recourse. A “statute of limitations” applies not just in court, but in the practical world of consumer rights.

Upon receiving a bike shipped directly to you, your first priority is a thorough inspection. Document everything with photographs: the condition of the box, every scratch or dent, and any component that appears damaged or improperly installed. You must assemble and test the bike immediately. Most credit card companies offer a 60 to 120-day window to dispute a charge for a defective product. If you wait until day 121 to discover the frame is bent, you may have forfeited your most powerful tool for resolution.

This is where the infamous “serviceability liability” of DTC bikes becomes a stark reality. If you discover a problem, you can’t simply take it to the nearest bike shop. As one user on a popular forum succinctly put it:

If you didn’t buy your bike there they don’t even want to talk to you. So if you go with a direct-to-consumer seller, know that you’ll be relying on them for distant support and parts availability.

– Forum user experience, Electric Bike Review Forums

You are at the mercy of a customer service email address and a shipping department located hundreds or thousands of miles away. A local shop, by contrast, has a vested interest in your satisfaction and provides an immediate, in-person point of contact to resolve issues. The purchase price includes this essential project management and dispute resolution service.

Key takeaways

- Total Cost of Ownership (TCO) is king: The sticker price is only the beginning. Factor in assembly, inevitable maintenance, and potential warranty-related labor and shipping costs.

- Brand matters for asset value: Name-brand e-bikes from local shops hold their value far better than generic “white label” online bikes, acting as a more stable financial asset.

- Serviceability is a financial liability: Owning a bike that no local shop will touch is a massive risk. A local shop purchase includes an invaluable “serviceability insurance” policy.

Step-Through or High-Step: Which Frame Geometry Fits Your Life?

While seemingly a question of pure aesthetics, the choice between a step-through and a high-step (or step-over) frame has direct implications for the bike’s utility and, therefore, the return on your investment. A bike that is difficult or uncomfortable to use becomes a worthless asset, gathering dust in the garage. Choosing the right geometry ensures the bike seamlessly integrates into your life, maximizing its use and value.

The high-step frame, with its traditional diamond shape, offers greater structural rigidity. This is advantageous for more aggressive riding, off-road trails, or for heavier riders who may notice flex in other frame types. The geometry provides a more engaged, performance-oriented riding position.

The step-through frame, however, offers superior practicality for daily use. Its primary advantage is ease of mounting and dismounting. This is not just a convenience but a critical feature for:

- Riders with hip or knee mobility limitations.

- Urban commuting involving frequent stops at traffic lights.

- Carrying cargo or a child seat on a rear rack, where swinging a leg over is impractical.

- Riders wearing business attire or clothing that restricts movement.

From a financial perspective, the step-through frame also appeals to a wider demographic, which can make the bike easier to sell on the secondary market later. The ultimate decision should be based on a realistic projection of your usage. Don’t buy a high-step frame for its “sporty” look if your reality involves grocery runs and commuting in work clothes. The most financially sound choice is the one you will use most often, most comfortably, and most safely.

Frequently Asked Questions about E-Bike Purchasing & Warranty

How long do I have to dispute a defective e-bike purchase with my credit card?

Most credit card companies provide a 60-120 day window to dispute a charge for a defective product.

What’s the difference between a parts warranty and a service warranty?

A parts warranty only covers replacement components but you pay for labor ($75-$150/hr). A service warranty includes both parts and labor.

Can I get warranty service at any bike shop?

Most shops won’t service bikes they didn’t sell. Direct-to-consumer bikes often struggle to find local service even for paid repairs.